Figuring out how criminals conduct business is a key part of investigations. Tracking down identity thieves, money launderers, organized crime groups and many other offenders requires detectives to trace transactions and decipher the intricacies of finance. However, more than half of the law enforcement agencies surveyed by PricewaterhouseCoopers in 2016 stated that they lacked the personnel with the appropriate skills to investigate and prosecute economic crimes.

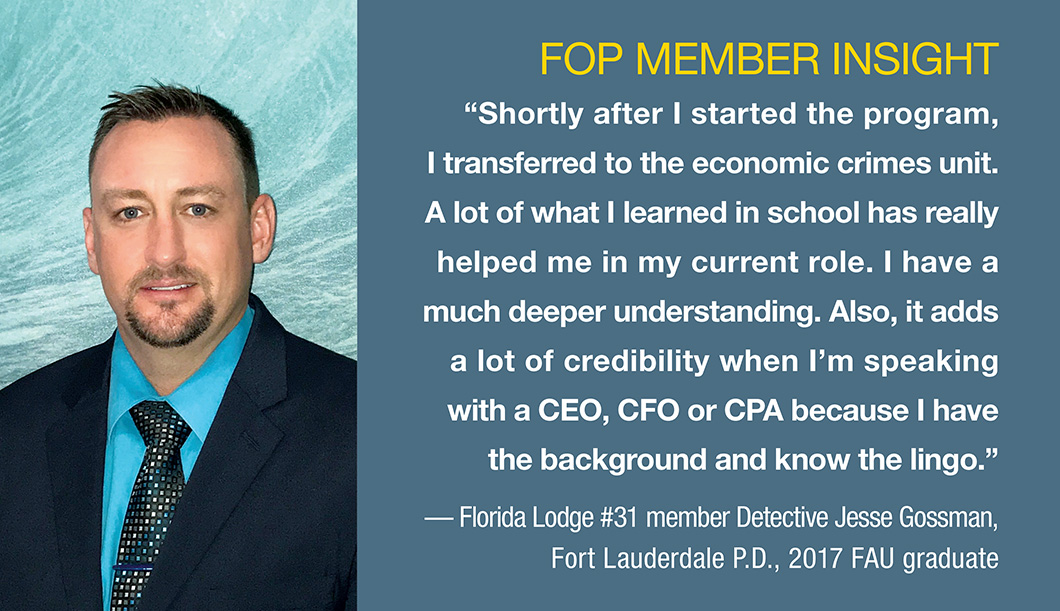

Therefore, officers who combine accounting expertise with their policing and investigative experience can multiply their professional opportunities with local departments, state and federal agencies, and even in the private insurance and financial sectors as fraud investigators. “From the law enforcement side, you have already built skills in investigation with people and understand what courts are looking for,” says FOP member Jesse Gossman, a detective in the Fort Lauderdale Police Department economic crimes unit who earned a master’s degree in accounting from Florida Atlantic University in 2017. “That really helps when investigating fraud. It’s not just about numbers; you have to interview people and be able to read them.”

For knowledge that can earn career dividends, check out these higher-education programs.

www.utica.edu

Degree: Bachelor of Science in Fraud and Financial Crime Investigation

Course sampling: Economic Crime Theory; Corruption and Organized Crime

Key components: Utica is one of the first universities in the nation to offer a full undergraduate degree in fraud and financial crime investigations (FCCI). The program’s interdisciplinary structure combines criminal investigation, accounting and computer skills. Participants can select between fraud prevention and detection or financial investigation concentrations.

Faculty insight: “[This] program is one of the few criminal justice-oriented programs that is designed to equip graduates with the skills to investigate criminal and civil offenses in the area of ‘white collar’ crime in both public and private sectors.” — Don Rebovich, Ph.D., coordinator, FFCI Programs

www.uiu.edu

www.uiu.edu

Degree: Bachelor of Science in Accounting

Course sampling: Federal Taxation; Auditing

Key components: Before you can chip away at the financial details of a case, you first have to understand the language and systems standard to the accounting profession and financial institutions. That’s the focus of an accounting major at Upper Iowa University. Classes are available at the Fayette campus and select education centers, as well as online and through a self-paced degree option.

Faculty insight: “Law enforcement professionals add value to the classes because they have the real-world experience that serves as a teaching lesson to us all. They have seen and dealt with the issues that forensic accountants evaluate and investigate in the business world.” — Dana Leland, Ph.D., adjunct instructor

www.fau.edu

Degree: Executive Master of Accounting with Concentration in Forensic Accounting

Course sampling: Interviewing for Forensic Accountants and Auditors; Advanced Accounting Information Systems

Key components: In this two-year online program, field-experienced faculty delve into fraud, litigation support, money laundering investigation and expert testimony. Applicants must hold a bachelor’s degree, but 10% of current students are CPAs.

Faculty insight: “I use case studies I actually worked on. I have them look at what the accounting produced and violated, and then look at the external controls and analyze what the people involved believed.” — Jay Leiner, CFE, Ph.D., professor and FOP member (Florida Lodge #32)

www.webster.edu

Degree: Master’s in Forensic

Accounting

Course sampling: Legal Procedure, Substantive Law and Professional Ethics in Forensic Accounting; Special Topics in Litigation Accounting

Key components: The program consists primarily of evening classes at Webster’s St. Louis campus. Coursework covers many of the legal elements of forensic accounting, including procedures and analytics, in addition to functional aspects, such as auditing and valuation.

Faculty insight: “This is a comprehensive program. Part of the program is to apply forensic practices, not just going over accounting theory.” — Rich Dippel, JD, MBA, CPA, Business Department chair and associate professor

www.tiffin.edu

www.tiffin.edu

Degree: Bachelor in Accounting or Criminal Justice with Forensic Accounting Minor

Course sampling: Analysis of the Accounting Process; Accounting Information Systems

Key components: In this cross-functional minor for both accounting and criminal justice majors, accounting students examine legal and investigative procedures, while criminal justice students gain a better understanding of transactional practices. As a criminal justice instructor and detective sergeant with the Seneca County Sheriff’s Department, FOP member Donald Joseph is a regular guest speaker in classes. “I explain how to do a timeline presentation to prosecutors. I also show what documents are needed and how search warrants are utilized,” he says.

Faculty insight: “The goal is for more people to get into investigative-related areas with financial fraud.” — Rhonda Gilreath, assistant professor of accounting

www.pnw.edu

www.pnw.edu

Degree: Graduate Certificate in Forensic Accounting and Fraud Investigation

Course sampling: Fraud Data Analysis; Advanced Fraud Investigation

Key components: Applicants must hold an undergraduate degree and have completed at least one introductory accounting course. Enrollees must pass four graduate courses that address both legal procedures and fraud prevention.

Faculty insight: “My favorite course to teach is the data analysis course because it allows me to demonstrate to my students how software can assist forensic investigators in their work.” — Maureen Francis Mascha, Ph.D., CPA, associate professor of accounting and Forensic Program coordinator

Click here for further insights from FOP member Jesse Gossman about the benefits of studying forensic accounting.

Read this story in the Spring 2018 issue of FOP Journal.